omaha ne sales tax calculator

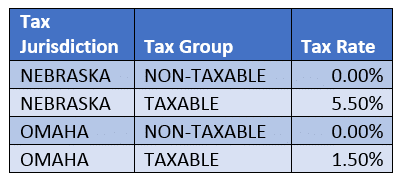

Name A - Z Sponsored Links. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15.

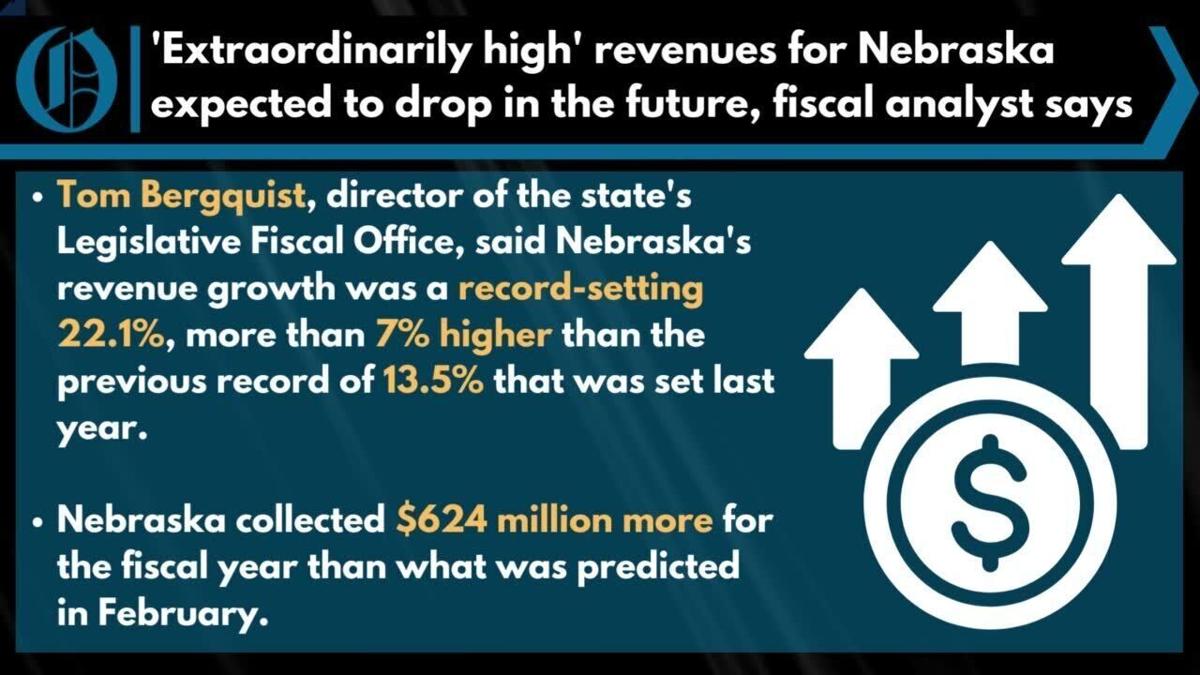

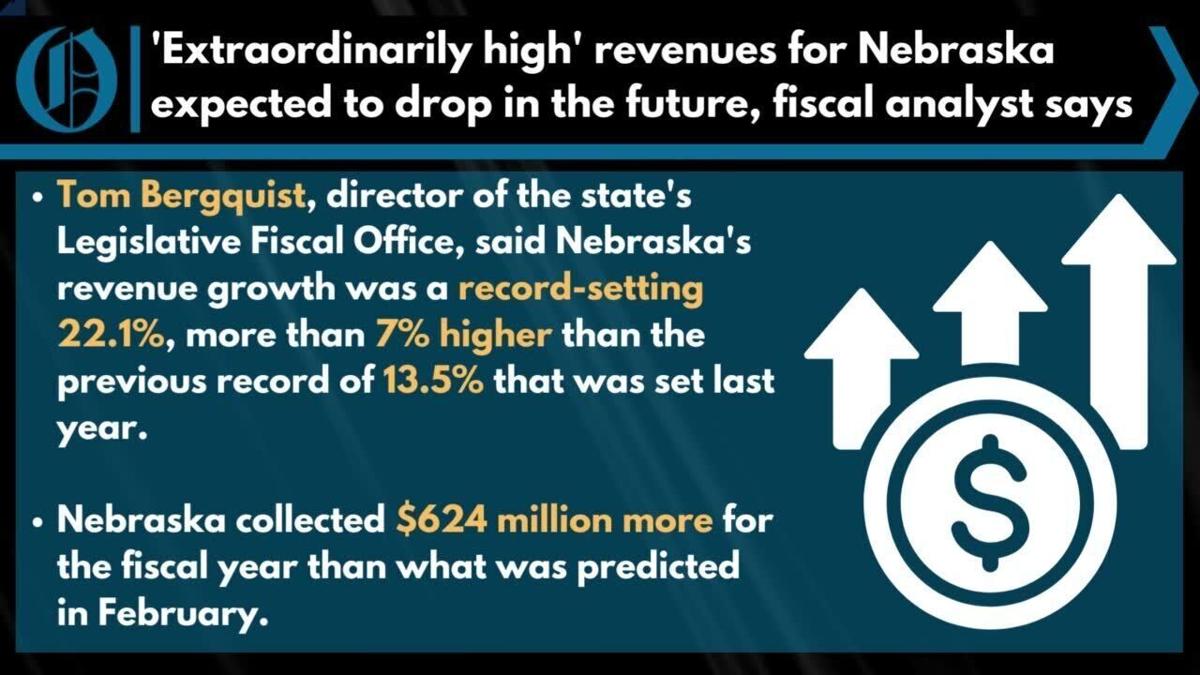

Extraordinarily High Revenues For Nebraska Expected To Drop Fiscal Analyst Says

Taxes-Consultants Representatives Tax.

. The Omaha Nebraska sales tax rate of 7 applies to the following 39 zip codes. The calculator will show you the total sales tax amount as well as the county city. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Nebraska NE state sales tax rate is currently 55. Make a Payment Only. Sales Tax Calculator in Omaha NE.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. The current total local sales tax rate in Omaha NE is 7000. Method to calculate Omaha sales tax in 2021.

The Nebraska sales tax rate is currently. You can find more tax rates and. Ad Sellers use our guide to keep current on all nexus laws and the collection of sales tax.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Sales Tax Rate Finder. Real property tax on median home.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. Avalara calculates collects files remits sales tax returns for your business.

Nebraska sales tax details. The minimum combined 2022 sales tax rate for Omaha Nebraska is. The sales tax information you need listed by individual states and updated in real time.

Driver and Vehicle Records. Sales and Use Tax. The Nebraska state sales and use tax rate is 55 055.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Taxes-Consultants Representatives Tax Return. Sales Tax State Local Sales Tax on Food.

The December 2020 total local sales tax rate was also 7000. Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance. If youre an online business you can connect TaxJar directly to your shopping cart and.

Request a Business Tax Payment Plan. See it in Action. This is the total of state county and city sales tax rates.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Registration Fees and Taxes. Method to calculate Omaha sales tax in 2022.

The Nebraska state sales and use tax rate is 55 055. Name A - Z Sponsored Links. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription.

Sales Tax Calculator in Omaha NE.

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

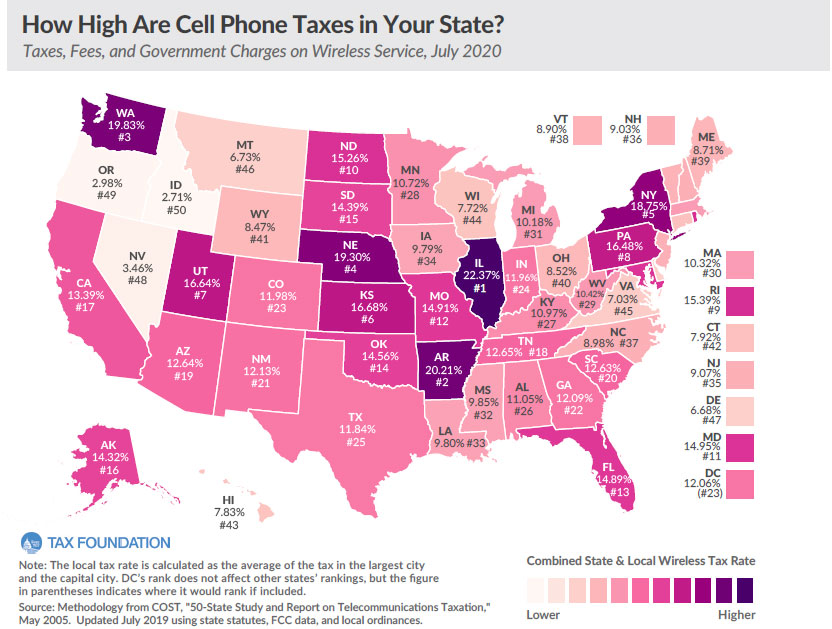

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

Nebraska Sales Tax Guide For Businesses

Georgia Sales Tax Rates By City County 2022

Omaha Property Taxes Explained 2022

Should You Move To A State With No Income Tax Forbes Advisor

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Calculate California Sales Tax 11 Steps With Pictures

Nebraska Sales And Use Tax Nebraska Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/ERD7U2NLDJAL5B5TXL3JGLQZ4Y.jpg)

Downtown Omaha Plan Adds Streetcar Puts Mutual Of Omaha Into Current Library Space